Many students pursue commerce stream and want to make their career in this field. They have to study so many subjects in this field, and accounting is one of its main subjects. While studying, many have questions in their minds: What are the uses of accounting? Are you one of them? If yes, then you come to the right place.

In this blog, we are going to tell you some important uses of accounting that are very useful for you. For example, the Tally software is used for maintaining records. For using it, you must have accounting knowledge and its uses. Also, several companies use the accounting test to find the best accountants for their business. Here you will get complete knowledge of accounting uses and its users. Moreover, if you are facing any difficulty in accounting, then you can take our experts’ help in accounting.

Brief information on accounting

Table of Contents

Accounting includes how your business works. It includes the recording, organizing, and understanding of financial information. Accounting determines whether a company is making a profit or not, cash flow, the present value of its assets & liabilities, etc.

According to R.N Anthony, “nearly every business enterprise has an accounting system. It is a means of collecting, summarizing, analyzing and reporting in monetary terms, information about business”.

What is the objective of accounting?

Accounting is also known as the ‘Language of business.’ It is a way of communicating information related to finance to various users for help in taking decisions.

The main objectives of accounting are as follows-

- To record transactions daily

- To help in proper planning and budgeting.

- To help in decision-making for users.

- To measure the performance of the business.

- To know the financial position.

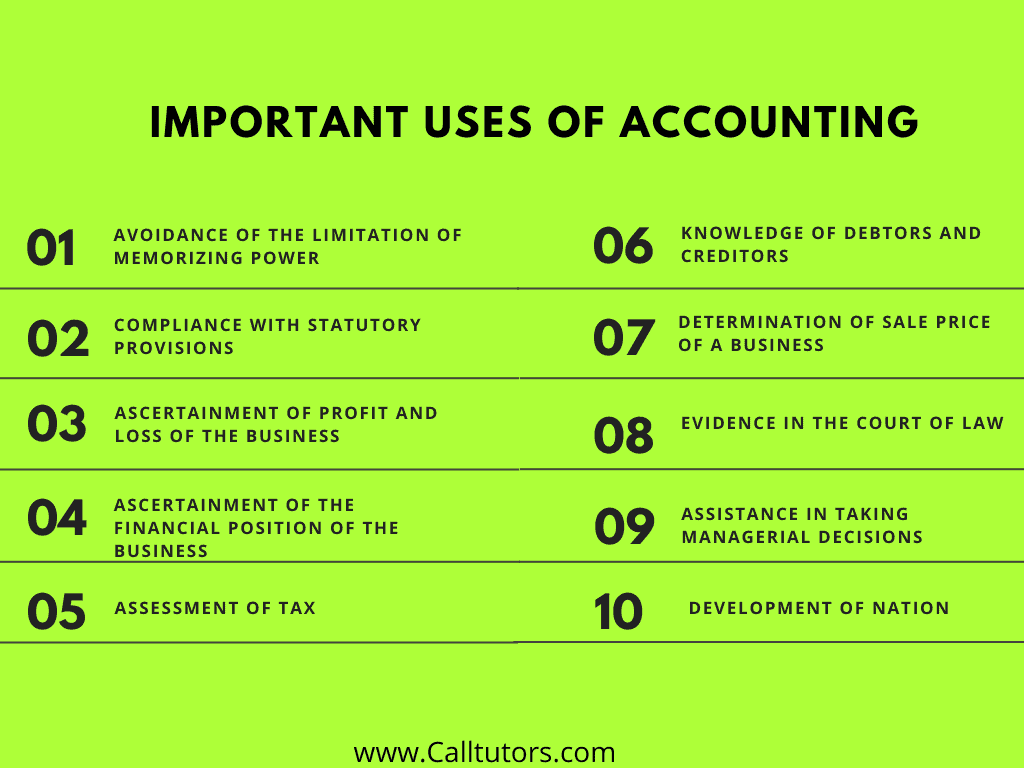

Important uses of accounting

There are so many uses of accounting, and there are the following main uses of accounting.

Avoidance of the limitation of memorizing power

Normally the accounting is used for business purposes or for remembering the records easily. To remember all the business transactions it is very difficult to remember all the things for any businessman. And we can say that it is impossible to remember all the things for any businessman or for any other people it is not possible to remember things, it is because of the human memory limitation. To record all the transactions accounting is very helpful, whenever the businessman wants to check the records, he can check that records easily.

Compliance of Statutory provisions

In the business, the recording of transactions is a must from the accounting point of view. And all the statutory provisions are fulfilled with the help of accounting. In simple language, we can say that it is very important to make records of all the cash. And also in the companies which are the joint-stock companies, the purchase transaction, and the sale transaction must be recorded.

Ascertainment of profit and loss of the business

Any person who starts its business they want to get or want to earn profit in their business. Earning profit is the main purpose of any business which is started. In any business, there are two clear results in any business that is the profit or loss. This is not fixed in any business that there is every time profit or loss. But for any business to get the correct business profit or loss calculation, it is must to record correctly by adopting the accounting principles.

Ascertainment of the financial position of the business

From the financial statement, at a specific date, the knowledge of the assets of the company and its liabilities are found by the company. And the meaning of the assets is all the business sources and the meaning of the liabilities is the payable business amount. In any business, it is very important to calculate the correct financial position. Therefore it is a must for the businessman that he should have all assets and the liabilities records in accounting to get the accurate calculation of the financial position.

Assessment of Tax

Nowadays there are so many taxes which a businessman has to pay. And the taxes which a businessman has to pay are like income tax, property tax, sale tax, import duty tax, excise duty tax, customs duty tax, etc. If the businessman makes accurately records its production, sale, and income then the accurate calculation is possible only. And it is a must for the businessman to pay all these taxes properly. But if the record is not made properly by businessman then the officers which check the records of the taxes of all businessman. And the officer which checks the record of the taxes is the assessing officer. Accessing officer calculates the amount of tax with his own estimation.

Knowledge of Debtors and Creditors

Now the businessman, with the help of accounting, can easily find all about the amount. Like all the knowledge of debtors and creditors. From the debtors what amount is pending can be easily found by the businessman. And to creditors, how much amount is paid can be easily found by the businessman. All this possible, only if the accounting records are maintained properly. So it is so vital to make the records properly with the help of accounting.

Determination of sale price of a business

For determination of the sale price of a business for selling the active business by the businessman can be easily determined. Selling the business to another party and the value of the active business which the businessman wants to sell can be easily found if the records are made properly. If the business investments are records properly by the businessman, then the sales price of the active business determined easily.

Evidence in the court of law

If in the future there are any arguments between the two parties. So the court wants proof and then the account records will work as proof. And in front of the court, the accounts which are recorded properly will work like proofs for the court and the court accepts the account transactions like evidence. So it is necessary for the businessman to keep its records of the accounts clear.

Assistance in taking managerial decisions

To take the decision like the managerial decision accounting is helpful for taking that type of decision. And the decisions which are the managerial decisions are like calculating the goods and services price, calculating the product mix and sale mix, decisions of the purchase, the uses of plants differently, decisions of the business continue or close, decisions of the machinery replacement, for any specific order decision regarding acceptance, and the tenders regarding decisions, etc.

Development of nation

For the development of a nation, accounting helps a lot. Accounting can develop the nation like when the businessman makes its records correctly. When the businessman makes its records properly then it means they cannot save the money which is called black money. So it means they cannot steal the tax which they have to give to the government. If the businessman cannot steal the tax then it means they have to give that tax to the Government. And the Government can utilize these taxes for the development of the nation. So with the help of the taxes which are paid by the businessman, the nation’s development is possible.

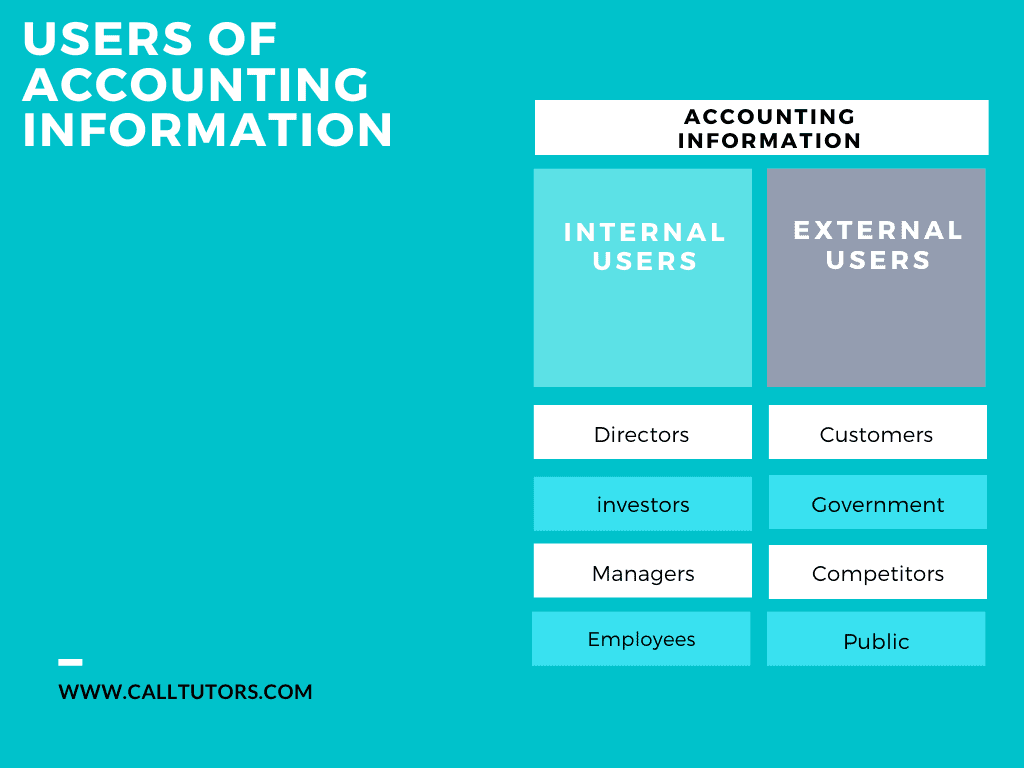

Additional point: Users of accounting information-

There are two types of users of accounting information-

1 Internal users-

These are those who are part of the company or working in it, such as directors, employees, managers, etc.

2 External users-

These are those who are the investors of the company. They are the outsiders of the business entity. They use accounting information. The external users are customers, government, competitors, etc.

For example,

1 If a person wants to invest in your company, how can they get the information of your financial position?

The answer to this question is that he or she will check your accounting information which you release publically. These reports also help shareholders to know about you.

2 If the company directors want to make financial planning of a specific year of a company, how can they see the company’s recent financial position?

The solution is that they can see the financial records of the company, which their accounting departments maintain throughout the year.

Conclusion

Accounting is used in every field. Without it, it is not possible to maintain the records. Now you have seen all the important uses of accounting, and we hope you can understand mostly all about the main uses of accounting. We also mention users of accounting information with examples. It will help you know about them.

Also, if you are a student who needs accounting assignment help, contact now to chat with an expert.

Frequently Asked Questions

Who uses accounting?

There are two types of users. One is internal users, who are company owners, managers, and employees. Others are external users, who are people outside the business entity. External users are customers, investors, suppliers, banks, tax authorities, etc.

What are the three golden rules of accounting?

1. Debit the receiver and credit the giver.

2. Debit what comes in and credit what goes out.

3. Debit expenses and losses, credit income and gains.

What is the use of accounting in our daily lives?

It is the process of collecting, recording, summarizing & analyzing financial data or transactions. Accounting skills can be used in our day to day life. There are many applications for life-long learners who have a thirst for learning to account.

Is accounting important to you as a student?

Accounting helps the students handle money, calculate how much money they need, handle their expenses, and how money can be generated and helps them in their academics.