Each commerce student is well familiar with the term accounting and what it means. Accounting is a valuable field to make a career for students.

It is undeniable that accounting is a boring and difficult subject for some students, but meanwhile, it is a fascinating subject for others. Many students find it very difficult and hence search for accounting assignment help from experts on online platforms.

A major reason that compels the students to take their steps back in accounting is that they are unaware of why is accounting important.

In brief, accounting is important for business practices and other fields such as hospitality, practical life, small businesses, etc.

Before discussing the importance of accounting, let’s include the basic knowledge-What is accounting and its types along with the question why is accounting important?

Accounting includes the systematic and complete record of a company’s financial transactions.

What Is Accounting And Its Types?

Table of Contents

According to Smith and Ashburne, “Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions, and events, which are, in part at least, of a financial character and interpreting the result thereof.”

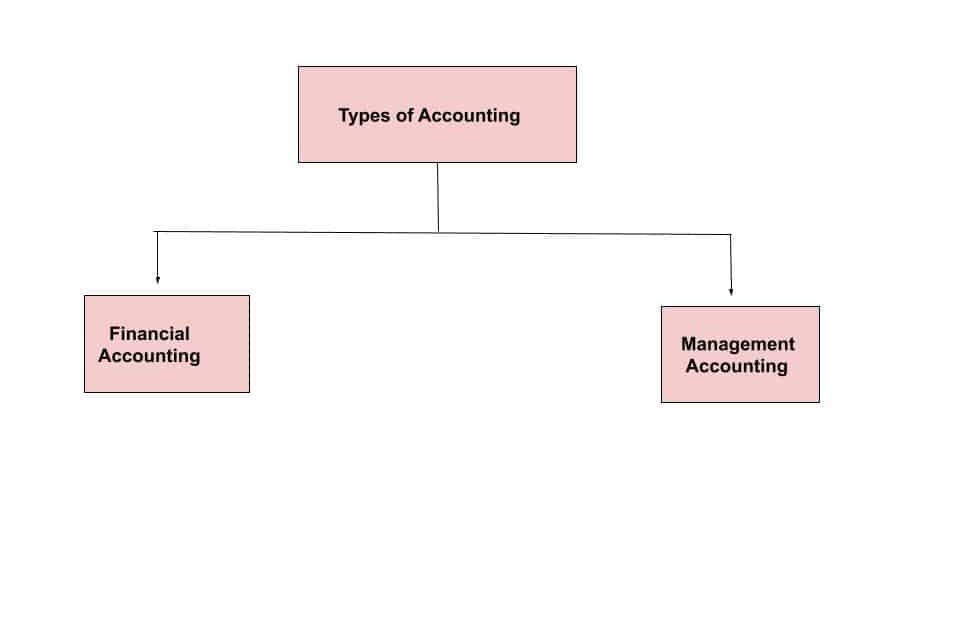

Types of Accounting

There are two types of accounting-

Financial Accounting

The preparation of reliable financial statements is a part of financial accounting. Financial accounting aims to calculate a company’s performance as precisely as possible. Although financial statements are meant for use by outside parties, they can also be used by internal management to help in decision-making.

Management Accounting

Management accounting gathers data, which is then analyzed by financial accounting. It refers to the method of compiling information on a company’s activities. The management committee uses the reports, and it helps them make operational decisions.

Objectives of Accounting

Accounting plays its role in different business activities and helps to grow the business. There are various branches of accounting that each have different objectives. The primary objective of accounting is to maintain a systematic record of financial transactions.

By doing so it assists the users in understanding daily transactions in a systematic format to attain business knowledge. Other objectives are-

- It protects the business properties

- Ascertaining the net profit

- It helps the businessman to determine the financial position

- Enhance the decision-making process

- Act as an information system for management

Reason Behind Why Is Accounting Important?

Do you want to know, “Why does accounting matter so much? What are the reasons behind its importance? Let’s know from below its main ten reasons:

- It is good for the financial analysis of a particular company, for nonprofit organizations, important for startups, or organizations like healthcare, lawyers, and in every industry.

- Moreover, accounting is mandatory for every industry to keep the business organized.

- The accounting system helps the industry to evaluate business performance.

- Apart from this, the accounting system helps all organizations stay within the law or follow all rules or regulations the government makes.

- It also helps the company with good future projections and budgeting pertinent data.

- In addition, the best report and evaluation of accounting helps you avoid audits.

- Another reason why accounting is important is that all chartered accountants (CA) know how to deal with large amounts of money or complex taxes.

- Also, it is good to improve an organization’s decision-making process.

- Good accounting helps you get more deductions, tax deductions, GST deductions, prepare clients for crypto tax planning, etc.

- The last reason is that the best accounting system saves an organization time.

Why Is Accounting Important In Various Fields?

Accounting is very beneficial to companies. But do you know it is also very beneficial in every field that involves transactions? Let’s discuss various departments and activities in which accounting plays an important role.

Why is accounting important in everyday life?

Accounting is vital for recording daily transactions, enabling precise tracking of expenses and income. This financial awareness is crucial for decision-making. Businesses can streamline this process through outsourced accounting services, gaining specialized support for accurate and organized financial management, while focusing on core activities.

Why is accounting important in small businesses?

Although small businesses have very few amounts involved in their transactions compared to big businesses, keeping a record of all their transactions is still necessary. Accounting is very important in small businesses as it helps track the financial condition so we can make corrective decisions.

Why is accounting important to society?

Thousands of activities occur in a society during a specific period. Various predictions and forecasts are based on those activities and transactions. Accounting helps to keep track of all those transactions that have taken place within societal boundaries.

Why is accounting important for investors?

Accounting helps investors to know about the actual financial condition of an organization. Investors can compare the financial statements of different organizations and analyze them. This comparison helps them to make wiser investment decisions.

Why is accounting important in the hospitality industry?

The hospitality industry is based on word of mouth. The experience of the previous customers will be the reason for the expansion or destruction of a hospitality organization. Accounting helps to track the financial status of your organization. If the financial status of a hospitality institute shows a positive change, then its beneficial or vice versa.

Why is accounting important for businesses?

Accounting is essential to the success of any business because it assists you in tracking expenditures and income, maintaining statutory compliance, and offering quantifiable financial information to investors, management, and the government that can be used to make business choices.

Your records generate three important financial statements.

- The income statement informs you how much money you earned and lost.

- The balance sheet gives you a clear picture of your company’s financial situation on a specific date.

- This statement shows how much money was generated and spent over a period of time as a bridge between the income statement and the balance sheet.

Keep your financial records up to date and clean if you want to keep your business afloat. Here are a few reasons why is accounting important in business, no matter how big or little!

It Helps in Evaluating The Performance Of Businesses

A small business or corporation’s financial records show how the business is doing and its financial position. You can use them to understand what is happening financially with your business. Having clean and up-to-date records will not only allow you to keep track of expenses, gross margins, and possible debt, it will also allow you to compare your current data with previous accounting records, giving you better insight into your budget allocation.

It Ensures Statutory Compliance

laws and regulations vary from state to state, but proper Accounting systems and processes are essential for ensuring statutory compliance.

Accounting functions ensure that liabilities such as sales tax, VAT, income tax, and pension funds are properly handled.

It is useful in creating budgets and future projections.

Your financial records will play a crucial role when it comes to budgeting and future projections. Keeping your operations profitable requires understanding business trends and projections based on historical financial data. The financial data is most suitable when provided by a well-established accounting process.

It assists in filing financial statements.

The Registrar of Companies requires businesses to file their financial statements. Listed entities must file with stock exchanges and direct and indirect tax filing. Accounting plays a crucial role in all of these scenarios.

Purpose of Accounting

The ultimate purpose of accounting is to provide data to the specific individuals concerned. Those individuals then use that data to make economic decisions regarding different events.

Career prospects of accounting-

Many students think, why is accounting important? As per the career prospects, accounting is important for students. The role of an accountant is to report and interpret financial records responsibly. Small enterprises hire one accountant, but the large companies establish a complete accounting department.

The careers in accounting can vary broadly and may include various roles from tax planning to audit accounting. Students who want to become accountants must get certified by the CPA (certified public accountant). The four well-known companies with an entire accounting department are KPMG, PwC, Deloitte, and Ernst & Young.

Engaging point: Interesting facts about accounting

Do you think accounting is boring? If yes, then you are wrong. Here you will come to know about the lesser-known facts about accounting-

| 1 You know bubblegum was invented by Walter Diemar in 1928, who was also an accountant. The color of bubble gum is dark pink because at that time the only dye he had. |  |

| 2 Luca Pacioli, an Italian mathematician, is called the father of accounting. He wrote the book on the double-entry system for the first time in 1494. The surprising part is that Leonardo da Vinci was one of his students. |  |

| 3 You must hear about the famous award, Oscars. Since 1935, every year, an accountants team spent around 1700 hours before Oscar night to count the academy awards ballots by hand. |  |

Conclusion

There are lots of points that can showcase why is accounting important. But these are the major points that are showing why accounting is important for students. If the students start to implement accounting earlier in their academic sessions. Then they have saved a huge amount of money from the academics expenses.

Apart from that, it also helps the students to become self-reliant as soon as possible. Most of the students are not well aware of the basis of accounting. But don’t worry, we are here to offer you the best assignment in accounting with accounts assignment help. It helps you to clear all your accounting concepts easily. Now it might be clear to you why accounting is important for the students.

FAQ

What is the difference between accounting and bookkeeping?

Bookkeeping and accounting are both important for business purposes. Bookkeeping is responsible for tracking financial transactions, while accounting is responsible for classifying, analyzing, and interpreting financial data.

What are the limitations of accounting?

It records only monetary items.

There is no system for tracking events that may occur in the future.

You can not calculate the exact cost of a product.

There is always room for fraud and errors.

Information of accounting can not be used as the only test of managerial performance.

What is the role of an accountant?

An accountant has so many responsibilities they have to perform. For example, prepare a budget, financial model, calculate the cost, etc.